INNOVATE WITH Al-POWERED UNDERWRITING TECHNOLOGY

Introducing the missing piece in your credit decisioning process

Scale lending without adding agents or infrastructure

Automate while maintaining complete control of your underwriting program

Continuously learn and optimize credit decisioning using Al

HOW BANKANALYZE WORKS

Build and scale credit decisioning excellence in your lending business

Categorize and analyze thousands of bank statement transactions instantly.

Assess the financial health of your near-prime, sub-prime and thin-file applicants automatically.

Make better, more profitable lending decisions easily.

Grow lending without growing lending costs

Swap subjective manual data analysis with self-service, automated credit decisioning. From $10 per report - no monthly minimums or bulk credits required.

Stay in control of every lending decision

You set the credit rules you want applied across applications. Update anytime - hourly, daily or whenever you want.

.jpg)

Process applications 74% faster

Auto profiling creates a financial profile in seconds - from 20,000+ transactions (24 months of statements).

.jpg)

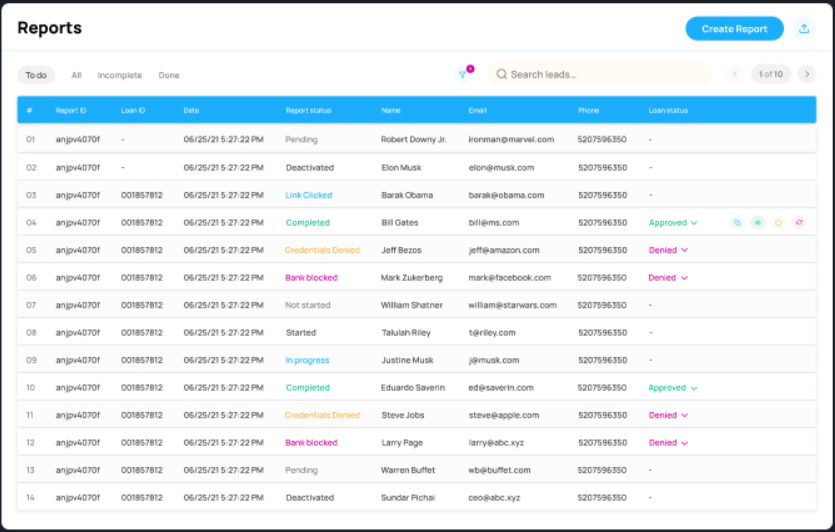

Save hours of agent application processing time with automated approvals

Based on your credit rules, the Al model automatically scores the application and provides an approve or decline recommendation.

.jpg)

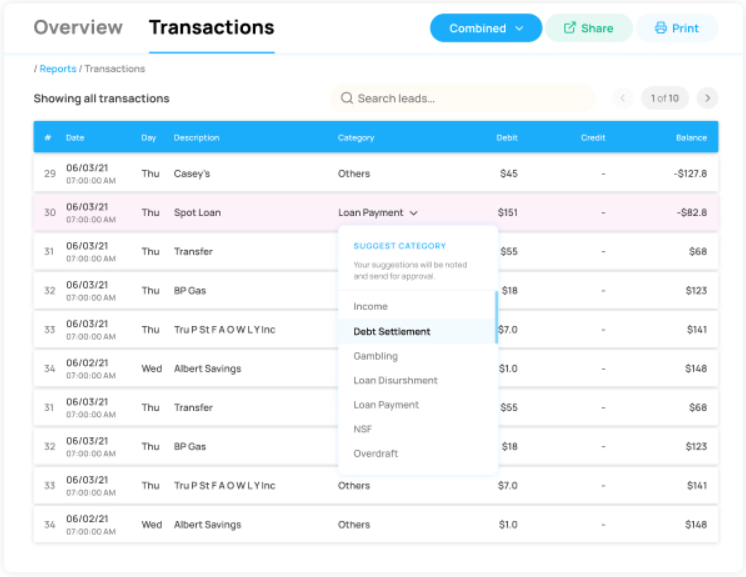

Continuously improve transaction tagging and reduce manual reviews

Agent-sourced transaction tagging and machine learning enable BankAnalyze to improve every time an agent steps in, analyzes a transaction and reprocesses a report.

Reduce first payment defaults

After disbursement, AutoAlerts help you get ahead of collection issues by continuing to monitor statements for the life of the loan.

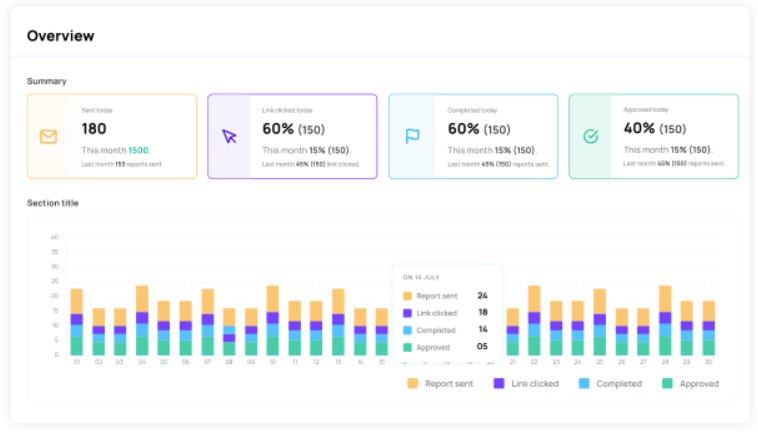

DO MORE IN LESS TIME

Surface credit- worthy applicants from risky ones. Instantly.

When you build Al-powered credit decisioning excellence, you can automatically process more applications in less time. With better quality. And less agent intervention.

WHAT OUR CLIENTS SAY ABOUT US

Loan portfolio performance measurably improves with BankAnalyze

Kamil Charazka

Chief Financial Officer / Co-founder TendoPay

80%

Decrease in application approval time

50%

Reduction in manual review time

65%

Increase in application approvals

GET STARTED TODAY

Build and scale decisioning excellence in your lending business

Get your free trial now to see how bankAnalyze can help you build and scale credit decisioning excellence.

- Automate risk assessment and Ioan approvals

- Increase approvals and acquire more customers

- Maintain control of your credit criteria and manage risk

- Reduce operational costs while boosting organizational effectiveness

- Build more profitable portfolios with Al underwriting technology

- Replace subjective agent-led analysis with objective machine-led